Gold to silver ratio drops below 100-day SMA, eyes fresh 2.5-month lows(金银比跌破100日均线,创近两个半月新低)

·Gold to silver ratio drops below the 100-day simple moving average (SMA).

·Ratio's violation of key support suggests silver is likely to continue outperforming gold in the near-term.

·The macroeconomic picture favors stronger gains in both gold and silver.

˙金价之比跌破100日均线(SMA)。

˙金银比突破关键支撑位,预示银价可能在短期内表现超越黄金。

˙宏观经济形势支撑黄金和白银的强劲上涨。

Gold to silver ratio, which indicates how much silver can be bought for one ounce of gold, has declined below its 100-day simple moving average (SMA) of 101.24, and could soon set fresh 2.5-month lows under the May 20 low of 99.50.

金银比显示每盎司黄金可以购买多少白银,金银比已经跌破100天日均线(SMA) 101.24。并可能会创下5月20日的99.50之下近2个月的新低。

The ratio hit a high of 126.56 on March 18 and has been falling ever since. It has declined from 115.35 to 100.00 in the last three weeks, courtesy of the sharp rise in Silver.?

该比率在3月18日达到126.56的高点,此后持续下降。在过去三周,由于银价的大幅上涨,金银比从115.35跌至100。

The white metal picked up a strong bid below $15 on May 7 and rose to a high of $17.63 on May 20. Gold, too, witnessed a rally from $1,680 to $1,765 during that time frame. However, in percentage terms, silver rallied 17.5%, outshining gold's 5% gain by a big margin and pushing the gold to silver ratio lower.

银价从5月7日低于15美元的价格开始上涨,一直升至5月20日17.63美元的高位。在此期间,金价也从1680美元上涨至1765美元。然而,从涨幅来看,银价涨幅达17.5%,远超于黄金17.5的涨幅,因此也推低了金银比。

Looking forward, both precious metals could continue to benefit from the escalating US-China tensions and the global economic pain brought on by the coronavirus pandemic. Optimism over easing of lockdowns across major nations could provide an additional boost to silver, a semi-precious metal/semi-industrial metal. The gold to silver ratio's decline below the widely-tracked 100-day SMA is also echoing similar sentiments.?

展望未来,中美紧张局势的升级和冠状病毒大流行带来的全球经济衰退,可能继续使这两种贵金属受益。对主要国家放松封锁的乐观情绪可能会进一步提振金融属性和工业属性并存的白银。金银比跌破100日均线,也反应了这一情绪。

Gold is currently trading at $1,732 per ounce, representing a 0.3% gain on the day. Meanwhile, silver is trading at $17.37, up 1.8% on the day.

金价目前1732美元/盎司,当日上涨0.3%。与此同时,白银价格为17.37美元/盎司,当日上涨1.8%。

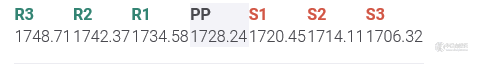

Gold technical levels (黄金技术点位)

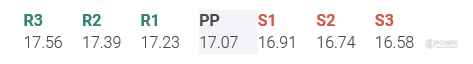

Silver technical levels(白银技术点位)

分析师:Omkar Godbole

文章来源:FXSTREET

(中国白银网编译)